Ytd federal withholding calculator

Exemption from Withholding. Take these steps to fill out your new W-4.

Hrpaych Yeartodate Payroll Services Washington State University

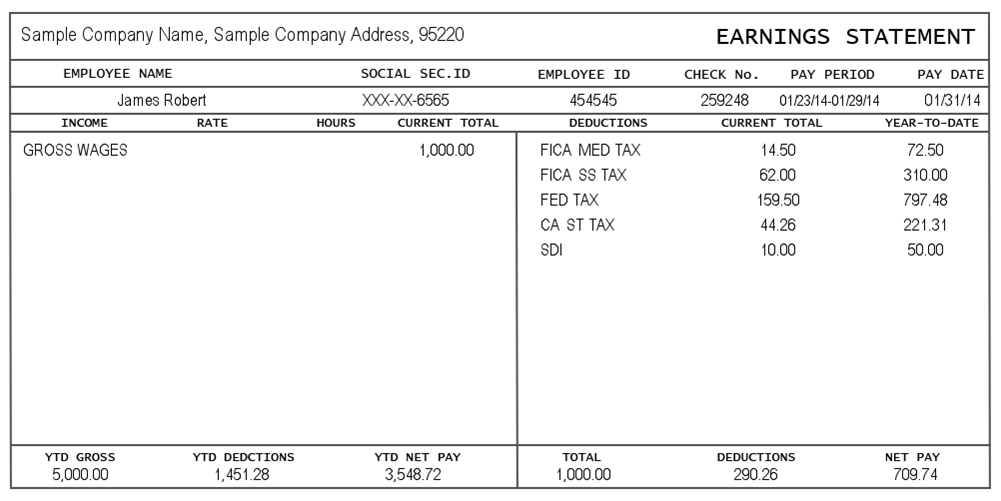

A pay stub should also list deductions for both this pay period and the YTD.

. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Federal taxes were withheld as if I worked 80 hours in one week almost 40. Raise your AC to 78 from 4pm - 9pm.

Instead you fill out Steps 2 3 and 4 Help for Sections. Free Federal and New York Paycheck Withholding Calculator. Earnings Withholding Calculator.

Prior YTD CP. Free Federal and Illinois Paycheck Withholding Calculator. 2022 Federal New York and Local.

2022 W-4 Help for Sections 2 3 and 4. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Until they decide to change the math formula to look at.

The tax calculator asks how much federal taxes am I paying ytd. Free Federal and New York Paycheck Withholding Calculator. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

10 12 22 24 32 35 and 37. This online calculator is excellent for pre-qualifying for a mortgage. ESmart Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs.

Free Unbiased Reviews Top Picks. 1547 would also be your average tax. Turn off unnecessary lights appliances - Learn more at.

Switch to Arkansas hourly calculator. IRS tax withholding calculator question. Or the results may point out that you need to make an estimated.

Free Federal and Illinois Paycheck Withholding Calculator. Urgent energy conservation needed. Feeling good about your numbers.

Federal Income Tax Withheld NA. 2020 brought major changes to federal withholding calculations and Form W-4. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Free Federal and New York Paycheck Withholding Calculator. The tax calculator asks how much federal taxes am I paying ytd.

10 12 22 24 32 35 and 37. 2022 Federal New York and Local Payroll Withholding. See the IRS FAQ on Form W-4 to answer your questions about the changes.

2022 W-4 Help for Sections 2 3 and 4. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. 2020 brought major changes to federal withholding calculations and Form W-4.

Federal taxes were withheld as if I worked 80 hours in one week almost 40. YTD federal income tax withholding can be entered in the W2 box. Free Federal and New York Paycheck Withholding Calculator.

Ad Compare This Years Top 5 Free Payroll Software.

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

1

Pay Stub Generator Free Printable Pay Stub Template Formswift

Payroll Calculator Free Employee Payroll Template For Excel

1

Us Enter Year To Date Ytd And Current Amounts Wagepoint

Us Enter Year To Date Ytd And Current Amounts Wagepoint

1

1

Payroll Tax Prep Tax Preparation Payroll

Calculate Civilian Equivalent Pay For Single 6 Year O 3 W No Dependents Finance Paycheck Paying

Net Pay Is Off By Cents

29 Free Payroll Templates Payroll Template Payroll Checks Invoice Template

Pin On Budget Templates Savings Trackers

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

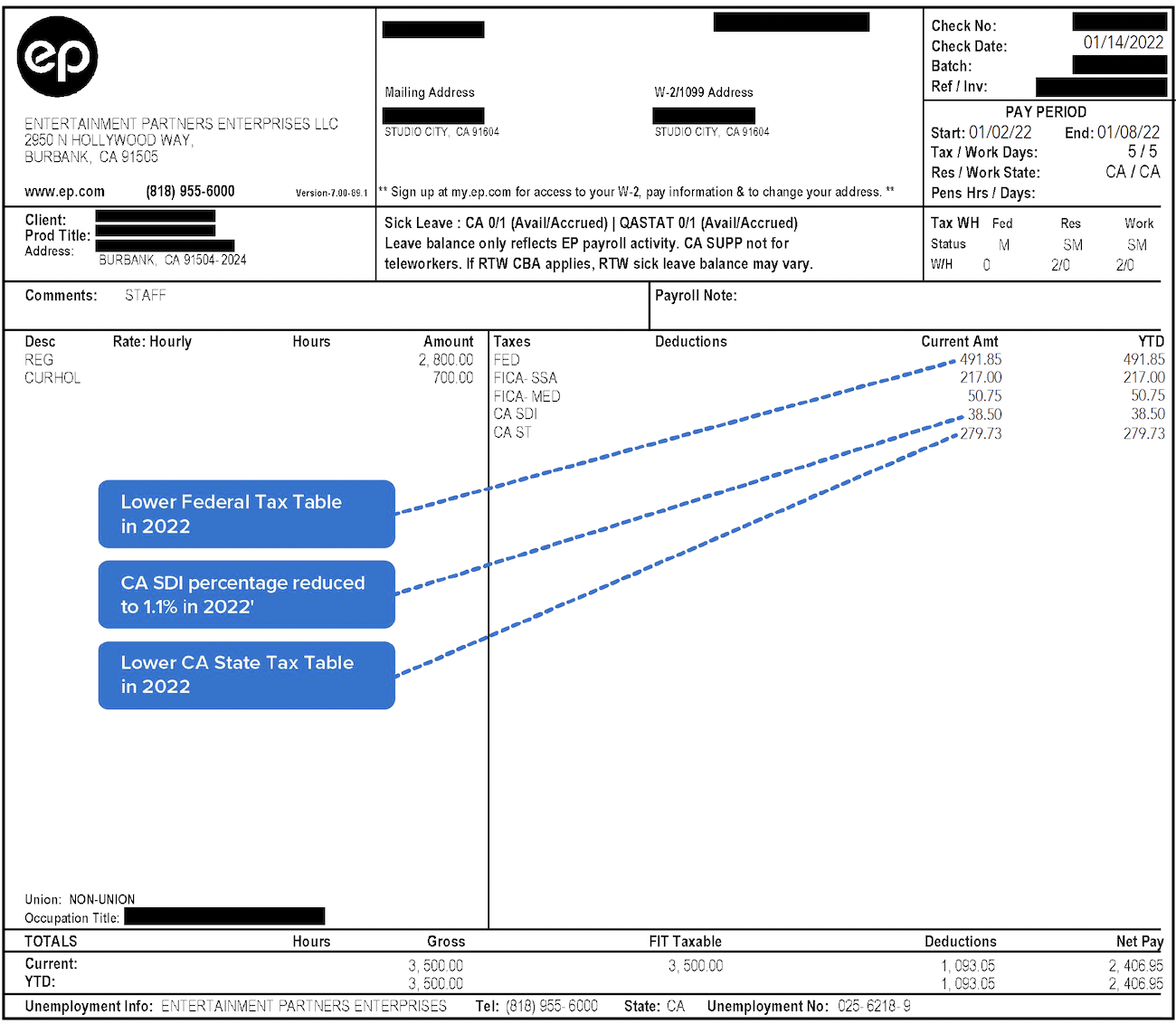

Decoding Your Paystub In 2022 Entertainment Partners

What Does Ytd On A Paycheck Mean Quora